A service firm is a specific kind of lawful entity that is clearly separate from its proprietors in terms of both financial and lawful obligations. This splitting up gives a considerable advantage as it restricts the owners' obligation for their investment in the company. Firms are generally structured to increase funding through the sale of shares, which represent possession parts of the business. This capacity to elevate resources much more quickly than other business kinds makes it a recommended option for several entrepreneurs and companies looking to expand. Firms are produced under the legislations of each state and call for a collection of actions for their development consisting of the declaring of Articles of Incorporation, and the development of bylaws which control their procedures.

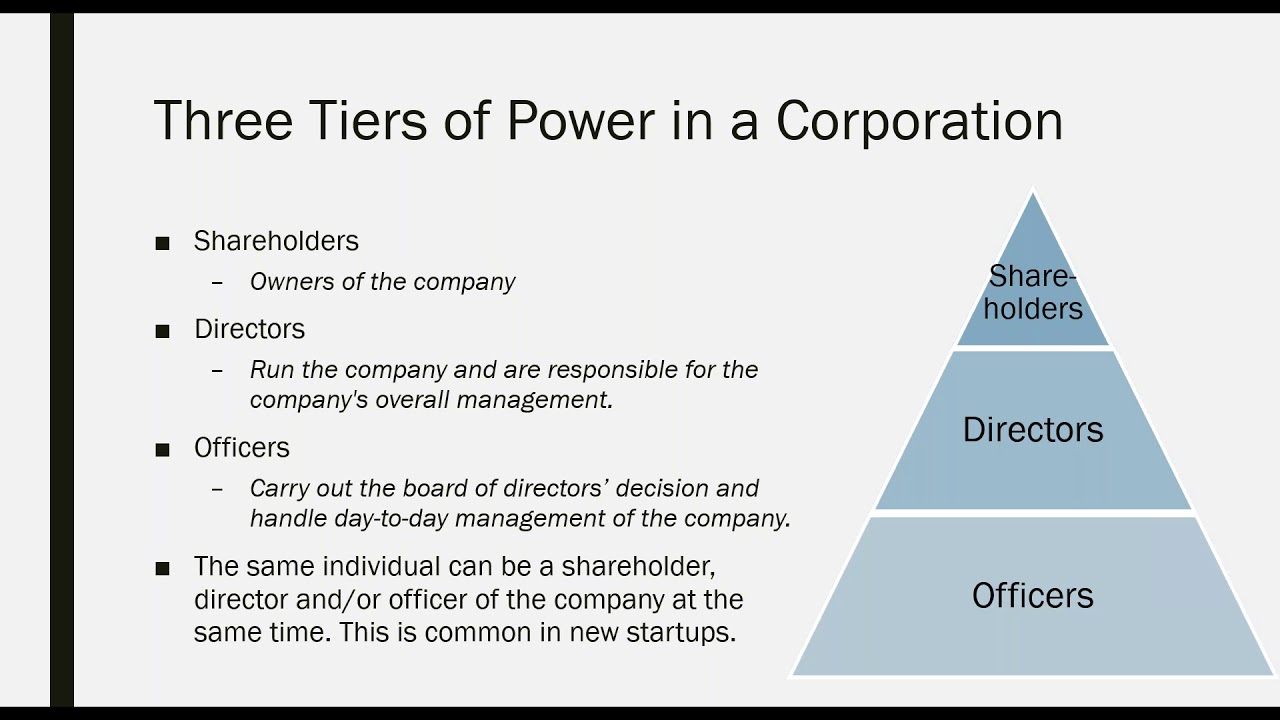

When developed, a firm should follow several regulatory conformities consisting of regular filings, board meetings, and investor meetings. These requirements make sure openness and responsibility, securing investors and the general public. The board of supervisors, elected by shareholders, supervises the firm's major policies and choices. Policemans, appointed by the board, take care of the day-to-day procedures. This department of duties permits specialized administration and administration, contributing to the company's efficiency and performance. Understanding the intricacies of exactly how corporations are structured and feature is vital for anyone involved in the company world, whether they are investors, managers, or policymakers.

Comprehending the Structure and Feature of Organization Corporations

A company firm is a legitimately defined entity specifically designed for carrying out commercial activities, supplying numerous benefits like restricted liability, prospective tax obligation benefits, and enhanced chances for elevating funding. Structurally, a corporation is complicated, making up various stakeholders consisting of officers, investors, and supervisors, each playing distinctive duties in its administration and operation. Investors are the owners of the company, who invest capital with assumptions of returns and have the power to elect the board of directors. The board holds the obligation for supervising the corporation's broad strategies and making significant choices. It designates police officers-- such as the President (CHIEF EXECUTIVE OFFICER), Principal Financial Policeman (CFO), and others-- who take care of the day-to-day operations and execute the board's plans. This separation of possession and monitoring permits the corporation to run separately of its proprietors, which is essential for handling massive procedures and numerous business deals efficiently. Furthermore, the legal standing of a firm as a different entity gives it the capacity to become part of agreements, get assets, incur responsibilities, and also pursue legal activity separately of its investors. The company structure also facilitates continuous existence, implying it can remain to run beyond the life-spans of its original owners or present members, a vital variable for lasting jobs and security. Fundamentally, business company is an essential structure in the international economic situation, making it possible for pooled resources and shared danger to promote expansive growth and advancement throughout sectors.

Managing and structuring Organization Firms

Service firms, as formal entities, provide a structure within which services can run, grow, and manage liabilities in manner ins which extend past the abilities of private entrepreneurs. At the core of their structuring is the splitting up in between the owners (shareholders) and the supervisors (execs), which is fundamental in guaranteeing an efficient functional pecking order. Shareholders invest funding and usually get involved in revenues via dividends and admiration in supply worth, yet they do not entail themselves in daily management tasks. This splitting up enables a clear delineation of obligations and experience, where executives manage the corporation based upon their expert experience and calculated vision. Further complexities in corporate administration entail the board of supervisors, elected by the investors to look after the broader administration technique, make certain legal compliance, and represent their interests. These supervisors play an important function in pivotal choices, consisting of the hiring and firing of execs, compensation plans, and significant monetary approaches. Additionally, firms need to follow a plethora of policies that regulate their procedures, from government securities regulations to state-specific regulations regarding unification, operational openness, and liability. Conformity with these guidelines not only makes sure lawful operation yet likewise improves credibility and dependability among capitalists and the public. how to check company details of these structural elements-- from investor duties to executive monitoring and governing conformity-- adds to the durable framework that defines modern company corporations. This framework is made not just to assist in organization procedures however additionally to secure the interests of the investors and the integrity of the monetary markets.

Trick Aspects of Organization Company Frameworks

On the planet of business, comprehending the details of company frameworks is crucial for anyone associated with the business sector, whether they are shareholders, supervisors, or possible capitalists. A corporation is a lawful entity that is different from its owners and can sustaining eternity past the lives of its investors. This structure allows a firm not just to be or file a claim against filed a claim against but additionally to have possessions, participate in agreements, and borrow cash under its own name. One of the main advantages of a business framework is the restricted responsibility it supplies its investors. Basically, this indicates that the personal properties of the investors are secured from cases against the corporation's responsibilities and financial debts. Firms can elevate extra funds with the sale of supply, which can bring in investors that may be reserved to spend in riskier company types with endless liability. The capacity to issue supply is a versatile tool for business funding that can be adjusted according to the firm's growth techniques and market conditions. An additional salient attribute of companies is their governance structure, usually defined by a board of supervisors in charge of making significant decisions and managing the general course of the business, while everyday operations are handled by supervisors and policemans. This splitting up of powers guarantees a structure where strategic and functional roles do not overlap, which can boost decision-making and operational effectiveness. In addition, corporations go through details regulative environments relying on their geographic places and the fields in which they run. Conformity with these regulations not just secures the firm from possible legal issues however also ensures stakeholders of the firm's commitment to moral and legal company methods. Operating within such structures, companies need to maintain openness with stakeholders via regular disclosure of monetary and operational performance, additional embedding trust fund and security in business relationships. This complex framework, while offering various benefits, also calls for precise interest to regulative and legal conformities, making the duty of business monitoring both difficult and vital in making certain lasting success and stability.

Comprehending the Structure and Administration of Company Companies

Organization companies are intricate entities characterized by their lawful framework and hierarchical administration, which are designed to simplify decision-making processes and safeguard the passions of shareholders. Central to a firm's structure is its board of directors, elected by investors to look after the broader monitoring plans and make calculated choices. This regulating body is essential as it holds the authority to designate elderly police officers, including the chief executive officer, who are accountable for the daily management of the business. The make-up and dynamics of the board can considerably influence the company's policy instructions, economic health and wellness, and total administration. Board participants typically bring diverse expertise and viewpoints, which can contribute to durable tactical preparation and raised company strength against market fluctuations and external pressures. Additionally, the board has a fiduciary duty to safeguard the shareholders' passions, choosing that tactically straighten with the lasting objectives of the company rather than private passions of the board participants. Openness and moral administration practices are likewise increasingly required by both regulatory authorities and the general public, pressing corporations to embrace more rigorous oversight devices. These mechanisms ensure that the firm not only goes after profitability however also abides by ethical and lawful standards, enhancing its credibility and sustainability in the affordable market. This organized approach to governance helps in mitigating threats, enhancing functional effectiveness, and making certain compliance with appropriate laws and policies, which completely strengthen the company's market placement and shareholder worth.